How to negotiate Winning All-Inclusive consulting rates

The economy seems to be improving and the SAP market also seems to be doing well. However, the rates for SAP consultants, all software professionals actually, and their standard-of-living seems to be under pressure, as always.

The daily complaining continues and the universal false perception that software has no value to anyone or society continues unabated.

Long gone are the days when software engineering was a highly respected profession.

That is why you must become an expert salary negotiator, if you want to continue to put food on the table, equipped with better knowledge about cost-of-living than your opponent(s): (clients, recruiters, vendor management companies, the foreign horde of cheap H1-B's promise-anything can't-deliver anything remote labor, international middlemen, automated corporate HR ATS robotic recruiting software currently flagging 95 million tech workers as unqualified and unemployable and other candidates undercutting your rate), and believe us when we tell you, your rate is all negotiable up to the moment the agreement is signed.

Negotiation Tactics - The Ultimate Salary Negotiation Tactical Planning Tool

That's why a couple of our in-house MBA's and true Software Engineers got together to develop a FREE online Consulting Rate Calculator, which can be used to help you negotiate, put real money back in your pocket and decide:

- What all-inclusive hourly or yearly rate should I ask for to take a particular job

- Whether you will make any money if you do take a job at a particular rate

- If a rate is being offered by a recruiter, whether it is a fair rate

- Whether you should keep your current job or take the new job

- What an acceptable percentage increase in salary is in order to take the new job

- Improve your salary negotiation

- What is the breakeven point with your out-of-pocket expenses if you take the offered job

- What are your out-of-pocket expenses

- What possible expense strategy can you take to make this job work out for you

- Stop guessing, use our quick online calculator and win better deals

- Show you how to negotiate salary

An Overview of How the Consulting Rate Calculator Works

Here is a quick demo of how it works.

Our Consulting Rate Calculator is agnostic, it can help you calculate changes in your cost of living so that you can maintain or improve your standard of living and it works with any global currency.

Thousands of consultants and recruiters including both On Shore and Off Shore have already used it.

The Yearly Performance Review

In our decades of consulting and work experience, we find there are a wide number of job offer scenarios, and we wanted to give you a couple scenarios with analysis to show you how to use this tool...to your advantage.

The first scenario is evaluating what an equivalent All-Inclusive job offer is, and so, we walk you through the analysis below.

Case Study #1: What is an Equivalent Job Offer?

We believe this job offer scenario applies to anyone, anywhere, with a current job, in any industry.

An Equivalent Job offer would be one that allows us to save the same amount of money over a period of time, say 12 months.

The Job Description Analyzer can see things you can't see

Using the following income and expense assumptions given below, let's use the interactive Consulting Calculator to determine what our current job is worth over a 12 month period.

We will use the two metrics "Yearly Net Income" and "Months to Breakeven" as our baseline to compare all competing job offers against.

These are automatically calculated line items on the Consulting Calculator.

We will then calculate what an equivalent all-inclusive job offer salary rate would be, depending upon your travel expenses.

We will then determine a reasonable consulting rate that is better than keeping our current job.

Finally we will look at Months-to-Breakeven followed by an overall job offer analysis summary that you can go to the bank with.

Benchmark Metrics

Our benchmark, "Yearly Net Income" is the total end of year savings after all expenses and income taxes are paid.

An Equivalent Job offer should match what we could save over a 12 month period if we did nothing and just stayed with our current job.

Any job worth taking, however, should pay us more than our current job and we will use the Consulting Calculator to determine what a worthy job upgrade rate might be.

All the values in this blog are static, however, if you would like to run this same Scenario in the Consulting Calculator in real time and play with the numbers to see what happens, then visit our Consulting Calculator and have at it.

(Note: When you use the Consulting Calculator remember, any income or expense value marked in the Income Statements in Yellow can be modified via the included 8 calculator questionnaire forms).

(Note: When you use the Consulting Calculator remember, any income or expense value marked in the Income Statements in Yellow can be modified via the included 8 calculator questionnaire forms).

Scenario Assumptions:

Current Job:

Home base assumptions: We have a local job with the following Salary and Expenses.

1) Current Hourly Rate: $43 / hr

2) Rent: $600 / mo (12 month lease, unfurnished, no utilities).

3) Personal Transportation (Car/Train): $200 / mo (gas, tolls, insurance, hypertube train fare, space elevator fees)

4) Food: $200 / mo. We mostly eat at home and prepare our own meals.

5) Utilities: $300 / mo. Our apartment lease agreement is such that we have to pay our own utilities.

6) Miscellaneous: $200 / mo. This could include entertainment expenses like dance lessons, cell phone bill, cable and internet, baby sitting, cat food or student loans, anything. Miscellaneous is a catch all category but this could be a sizable amount and the calculator does not care what it is (use it as you need to in the Consulting Calculator to fit your personal situation).

7) Tax Rate: 15%

Hot New Job Offer

Phone rings out of the blue. Recruiter found your resume on one of the job boards and just sent you an email about a hot new Role they are trying to fill and is wondering about your availability and your rate.

Based on the city, you have come up with the following major expense estimates.

Travel Expenses: Assume we have these additional travel related expenses.

1) Airfare: $4000 / mo. We assume we are like most consultants; we fly out on Monday morning or Sunday evening from our home base. And then we return to our home base either Thursday afternoon or Friday evening. We might work remote from home Fridays. We have estimated that each leg of the weekly trip costs $1000 / plane ticket and 4 trips per month are required to get to and from the job site. So in this assumption, we have budgeted $4000 / month for airfare.

2) Rental Car: $2000 / mo. If we fly, we have to rent a car most of the time. So we have budgeted for a worst case rental.

3) Hotel: $3000 / mo. A hotel is a large unavoidable expense. We have chosen a middle of the road hotel in this expense estimate.

4) Rent: $0 / mo. We assume that we are staying in a hotel and not renting an apartment near the job site in this scenario. One could re-run this scenario by setting the Hotel to $0 / mo and then would have to estimate a monthly rental amount for this expense category. Keep in mind that most rental agreements are always for a 12 month commitment. So if we have a 4 month project, we still have to pay for the apartment and utilities for a full 12 months.

5) Miscellaneous: $200 / mo. This is probably a low estimate for miscellaneous expenses. (You can adjust this amount on the Consulting Calculator).

6) Tax Rate: 25%. Our monthly income tax withholdings will be higher.

Entering the Home base and Travel rates and expenses given above into the Consulting Calculator and then running the calculator several times each time adjusting the "Job Offer Rate" up or down such that the "Total Yearly Net Income" for the "Travel - Income Statement" is roughly equal to the "Total Yearly Net Income" for the "Home - Income Statement", we generate the following Home and Travel Income Statements.

Let's take a look at the results because they are pretty interesting.

|

CURRENT JOB

|

|

EQUIVALENT JOB

|

|

|||

|

HOME - Income Statement

|

|

TRAVEL - Income Statement

|

|

|||

|

Income

|

|

Income

|

|

|||

|

Current Hourly Rate

|

43

|

Job Offer Rate -or- Quote / hr

|

114.55

|

|||

|

Daily Rate

|

344

|

Daily Rate

|

916

|

|||

|

Monthly Rate

|

6,880

|

Monthly Rate

|

18,328

|

|||

|

Yearly Rate

|

82,560

|

Yearly Rate

|

219,936

|

|||

|

Home Expenses

|

|

Travel Expenses

|

|

|||

|

Rent

|

600

|

Airfare

|

4,000

|

|||

|

Car (home)*

|

200

|

Rental Car (away)*

|

2,000

|

|||

|

Mortgage

|

0

|

Hotel

|

3,000

|

|||

|

Food

|

200

|

Food

|

200

|

|||

|

Utilities

|

300

|

Rent

|

0

|

|||

|

Miscellaneous

|

200

|

Miscellaneous

|

200

|

|||

|

Monthly Expense

|

1,500

|

Monthly Expense

|

9,400

|

|||

|

Tax Rate %

|

15

|

Tax Rate %

|

25

|

|||

|

Taxes

|

1,032

|

Taxes

|

4,582

|

|||

|

Total Monthly Expense

|

2532

|

Total Monthly Expense

|

13,982

|

|||

|

Fully Loaded Cost Rate / hr

|

15.82

|

87.39

|

||||

|

Total Monthly Income

|

4,348

|

Total Monthly Income

|

4,346

|

|||

| benchmark -> |

Total Yearly Net Income

|

52,176

|

Total Yearly Net Income

|

52,152

|

||

Analysis: We can see that if we are currently earning $43 per hour, over a 12 month period, after all our home base expenses plus income taxes are paid, we will have an after tax take-home pay of $52,176 per year or about $4,348 per month. This is our first benchmark metric.

We can also see that in order for us to take an equivalent job out of town, we would need to be earning $114.55 per hour and over a 12 month period, after all our job related travel expenses are paid, we will have an approximate take-home pay of $52,152 per year or about $4,346 per month.

Summary: Given the expense assumptions shown in the above table; If our current job pays $43 per hour and our Yearly Total Net Income is $52,176 and if our hot new out-of-town job offer pays $114.55 per hour and our Yearly Total Net Income is $52,152, then the jobs are roughly equivalent.

These two jobs seem to be equivalent, but there is a problem: we still have home base expenses that don't just go away.

Issue: There is a problem because we are still not actually equivalentm far from it. As we can see from the main Consulting Calculator page, there are 3 income statements:

- (Home base),

- (Travel)

- (Combined Home base + Travel).

The Issue is, just because we are traveling out of town every week does not mean that we no longer have home base expenses that somehow go away.

We still have the original home base expenses that we must also continue to pay, especially if we rent, have a mortgage, a family or cat at our home base.

When we combine the Home and Travel Expenses we can only earn $34,152 per year not $52,152 per year as shown in the "Overall - Profit and Loss Income Statement (Home + Travel)" income statement.

The $34,152 we earn while traveling is $18,024 less than our do nothing Total Yearly Income of $52,176 per year. Clearly, our all-inclusive hourly pay rate is still too low because we almost took a job at a far higher rate that actually earns less than our current job.

The reason is, when we travel, we are taking on $13,982 per month of additional travel related job expenses that we don't have in our do nothing current job.

The HOME + TRAVEL Income Statement

Let's look at the last "Home + Travel" Income Statement on the Consulting Calculator results page to see what the actual Equivalent Job offer rate would have to be in order to take that new out-of-town job offer without losing our shirt, taking a bath or getting a haircut.

|

Overall - Profit and Loss Income Statement

|

(HOME + TRAVEL)

|

|

|

|

|

|

|

Income

|

|

|

|

New Hourly Rate

|

127

|

|

|

Daily Rate

|

1,016

|

|

|

Monthly Rate

|

20,320

|

|

|

Yearly Rate

|

243,840

|

|

|

Home + Travel Expenses

|

|

|

|

Airfare

|

4000

|

|

|

Rental Car (away)*

|

2000

|

|

|

Hotel

|

3000

|

|

|

Food (away)

|

200

|

|

|

Rent (away)

|

0

|

|

|

Miscellaneous (away)

|

200

|

|

|

Rent (home)

|

600

|

|

|

Mortgage (home)

|

0

|

|

|

Food (home)

|

200

|

|

|

Car (home)

|

200

|

|

|

Utilities (home)

|

300

|

|

|

Miscellaneous (home)

|

200

|

|

|

Monthly Expenses

|

10,900

|

|

|

Tax Rate %

|

25

|

|

|

Taxes

|

5,080

|

|

|

Total Monthly Expenses

|

15,980

|

|

|

Total Yearly Expenses

|

191,760

|

|

|

99.88

|

||

|

Total Monthly Net Income

|

4,340

|

|

|

Total Yearly Net Income

|

52,080

|

|

The Just Equal to or Parity Rate:

Playing with the "Job Offer Rate -or- Quote / hr" field on the Consulting Calculator and running the Consulting Calculator several times, we are able to tune in our New Job Offer Rate that allows us to make some money.

We can see that in order for us to take an equivalent job out of town that earns a yearly net income of $52,176 per year, our rate would have to be a minimum of $127 per hour to hit "Parity" or "Equivalent To" our current job of $43/hr, not $114.

At $127 per hour, after all travel and home base expenses are paid, we would have an approximate take home pay of $52,080 per year at the end of the 12 month period, making our new job roughly equivalent to our current yearly take home pay.

But Wait! There's More:

Why would we take a job that just gives us the same Yearly Net Income?

We won't.

We have things fixed up and working at home so why pack up and move for a so called "Perm" job that will likely end in 6-10 months anyway once the project work is about finished?

We've all been there; we know most of these "perm" or contract-to-hire with possible extension jobs are just short-term projects in disguise to hook us into a lower rate. Oh the budget was cut again, the sponsor quit; we decided to do something different. Always some excuse. I hate it when that happens!

Most contracts have an employment at will clause saying "you can be cut for any reason or no reason at any time". Guess what? You be cut! And now you have less money in your bank account than you started with.

We need a Compelling Reason to a Take a New Job

There has to be a compelling reason for us to take the new job and make the move. I mean, after all, it takes 12 months to get out of a lease and if we own a house, it might take several years to actually sell it. So those home base expenses do not disappear right away even if we take a Perm job in a new city.

Higher Pay or Profit are usually good Compelling Reasons

In the calculator, we arbitrarily set the desired pay increase to 30 %. This means that in order for us to take the new job, we need to earn at least 30% more Total Yearly Net Income per year in order to compel us to up-root and take this new job.

The Consulting Calculator has a field called "Desired Pay Increase % / Profit Margin" that allows one to play around with the Profit Margin % to run what-if scenarios.

So what is a Compelling Job Offer Rate?

Let's run the Consulting Calculator with "Desired Pay Increase %" set to 30% and find out.

If our current monthly take home pay is $4,340 per month after all home and travel expenses are paid, the Consulting Calculator says we should ask for $135.14 per hour (All Inclusive Rate / hr) to make the travel job offer worthy of our consideration and we already know no job offer less than $127 per hour is worth considering because we would either lose money or be at parity with our current job that only pays $43/hr.

This seems like valuable negotiating information to know and you can get this insight from our interactive Consulting Calculator in just a few seconds.

We would like to point out that $135.14 per hour is $92.14 higher than $43 per hour (OMG that's so high Consultants make so much money!) but don't forget, the expenses are equally sky high at almost $16,000 per month which the Consultant must also pay out of their own savings.

No one ever mentions the sky high expense part.

Best Recommendation for this Scenario:

For an All Inclusive Hourly Rate or Yearly basis job, ask for this much money:

1) Hourly Rate: $ 135.14 per hour

but no lower than $127 per hour or you will earn less money than you currently do.

2) Yearly Rate: $ 259,468.80 per year

*assume 160 hours per month and 12 months in a year times Hourly Rate.

SUMMARY COMPARISON at $135.14 per hour

|

CURRENT JOB

|

|

EQUIVALENT JOB

|

|

|||

|

HOME - Income Statement

|

|

TRAVEL - Income Statement

|

|

|||

|

Income

|

|

Income

|

|

|||

|

Current Hourly Rate

|

43

|

Job Offer Rate -or- Quote / hr

|

135.14

|

|||

|

Daily Rate

|

344

|

Daily Rate

|

1,081

|

|||

|

Monthly Rate

|

6,880

|

Monthly Rate

|

21,622

|

|||

|

Yearly Rate

|

82,560

|

Yearly Rate

|

259,469

|

|||

|

Home Expenses

|

|

Travel Expenses

|

|

|||

|

Rent

|

600

|

Airfare

|

4,000

|

|||

|

Car (home)*

|

200

|

Rental Car (away)*

|

2,000

|

|||

|

Mortgage

|

0

|

Hotel

|

3,000

|

|||

|

Food

|

200

|

Food

|

200

|

|||

|

Utilities

|

300

|

Rent

|

0

|

|||

|

Miscellaneous

|

200

|

Miscellaneous

|

200

|

|||

|

Monthly Expense

|

1,500

|

Monthly Expense

|

9,400

|

|||

|

Tax Rate %

|

15

|

Tax Rate %

|

25

|

|||

|

Taxes

|

1,032

|

Taxes

|

5,406

|

|||

|

Total Monthly Expense

|

2532

|

Investment / mo-> |

Total Monthly Expense

|

14,806

|

||

|

Fully Loaded Cost Rate / hr

|

15.82

|

Fully Loaded Cost Rate / hr

|

92.53

|

|||

|

Total Monthly Income

|

4,348

|

Total Monthly Income

|

6,817

|

|||

| benchmark -> |

Total Yearly Net Income

|

52,176

|

Total Yearly Net Income

|

81,802

|

||

Second Metric

What is the Breakeven Point?

Definition: Breakeven is the point where we get our initial investment back, measured in "Months to Breakeven".

If the project ends before we hit breakeven, we end up losing money and our cash savings goes down (a bad investment).

If the project finishes after the breakeven point, then we can save "Total Monthly Net Income" each month for the duration of the project and our cash savings goes up (a good investment) - which is the whole point of working!

What Investment you ask?

First some background experience.

In most vendor management Consulting Contracts is a clause that spells out the Payment Terms.

It's usually 65 days or Net-30 days.

What this means is, your first time sheet will be submitted at the end of the first month of working but that is not when you get paid.

The first paycheck for month 1 work, will arrive at the end of the second month (called Net-30 days) of working or no later than 2 weeks after the end of the second month or 65 days from the first day you started working in the new job.

These time periods vary so to keep it simple, we used 65 day worst case payment delay in the Consulting Calculator.

It also means the consultant is financing the project by loaning the company the expense money interest free up to the breakeven point - and it is an unsecured loan at that because your contract can be cut at any point for any reason or no reason (employment at will) leaving you holding the bag with no way to collect or recover your unpaid out-of-pocket expenses.

This is your so called "Investment" because you had to front your money from past jobs for their project in order for you to take their hot new job.

Client wins because they got a consultant at below actual cost. Recruiter wins because they got their commission. You are locked into a money losing contract. Neither the Recruiter nor the Client has any skin in this investment game. You are the only one with any real cash at risk!

You have all the Risks.

So what is the Investment amount?

If we look at the expenses for the "TRAVEL - Income Statement" we see there are roughly $14,806 of travel related job expenses each month that the Consultant must pay on their own credit card.

The Consultant will eventually get this money back, hopefully, but not all of it at once and the first paycheck will not arrive till 65 days from day 1. Also keep in mind that in almost all cases, expenses have to be approved by the client, and they do not always approve either the expense or the expense amount.

So Net-30 payment terms means the Consultant will have paid 3 months' worth of travel related job expenses plus home expenses out of their own pocket on their own credit card before payment on the first customer invoice hits the bank.

(OMG Now that is a lot of money, in a bad way. You are bleeding cash outflow at a very high rate!)

The total investment amount = 3 months * $14,806 per month in expenses = $44,418

$44,418 is your maximum out-of-pocket cash you need to have on hand, before any earnings on this job start to flow back into your bank account.

Why is it 3 months and not just 2 months if you get paid at the end of the second month? It's because by the end of the 2nd month at day 65, you have already had to pay your expenses for month 3 so that cash has already gone out.

So unless the consultant has a line of credit worth at least $44,418 and at least $14,806 per month or this much cash in their personal savings account or can borrow it from Mom, then we don't think they can actually take this job.

They don't have the cash to pay for the expenses.

As you can see, the labor rate has very little to do with the total Consulting Rate.

Most of the Consulting rate is made up of travel related expenses that are outside the consultants control such as the airfare, hotel and rental car expenses.

Even if the consultant worked for just $1/hr, there is still $14,806 of travel related expenses that have to be paid and cannot be outsourced or off-shored because these are beyond the consultant's control.

But let's assume the consultant does have this much credit and can wait the full 65 days for the first pay check to arrive and things work out just fine.

In this case, when is the Breakeven point?

At the top of the Consulting Calculator is a field called "Months to Breakeven" (not shown in this blog). What this means is, if the "Total Monthly Net Income" is equal to $5,317 per month at $135.14 per hour, and if we have $44,418 of initial out of pocket expenses to earn back, then dividing $44,418 by $5,317 we get a "Months to Breakeven" of 8 months to earn back our full $44,418 out-of-pocket cash investment.

|

Overall - Profit and Loss Income Statement

|

(HOME + TRAVEL)

|

|

|

|

|

|

|

Income

|

|

|

|

New Hourly Rate

|

135.14

|

|

|

Daily Rate

|

1,081

|

|

|

Monthly Rate

|

21,622

|

|

|

Yearly Rate

|

259,469

|

|

|

Home + Travel Expenses

|

|

|

|

Airfare

|

4000

|

|

|

Rental Car (away)*

|

2000

|

|

|

Hotel

|

3000

|

|

|

Food (away)

|

200

|

|

|

Rent (away)

|

0

|

|

|

Miscellaneous (away)

|

200

|

|

|

Rent (home)

|

600

|

|

|

Mortgage (home)

|

0

|

|

|

Food (home)

|

200

|

|

|

Car (home)

|

200

|

|

|

Utilities (home)

|

300

|

|

|

Miscellaneous (home)

|

200

|

|

|

Monthly Expenses

|

10,900

|

|

|

Tax Rate %

|

25

|

|

|

Taxes

|

5,406

|

|

|

Total Monthly Expenses

|

16,306

|

|

|

Total Yearly Expenses

|

195,672

|

|

|

Fully Loaded Cost Rate / hr

|

101.91

|

|

| Total Monthly Net Income -> |

Total Monthly Net Income

|

5,317

|

|

Total Yearly Net Income

|

63,802

|

|

In short, if the project lasts longer than 8 months then we can save $5,317 per month after month 8.

However, if the project ends exactly on month 8 our savings account will have grown $0.00 over the previous 8 months. So even at $135.14 per hour we would have been better off staying at the Current Job if the project ends before the breakeven point of 8 months.

So you have to know the project durations in addition to rates and expenses to make a smart decision.

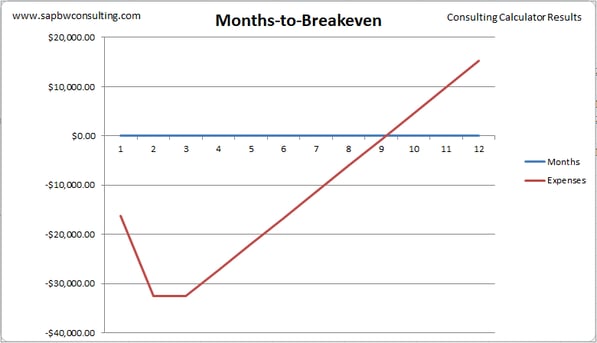

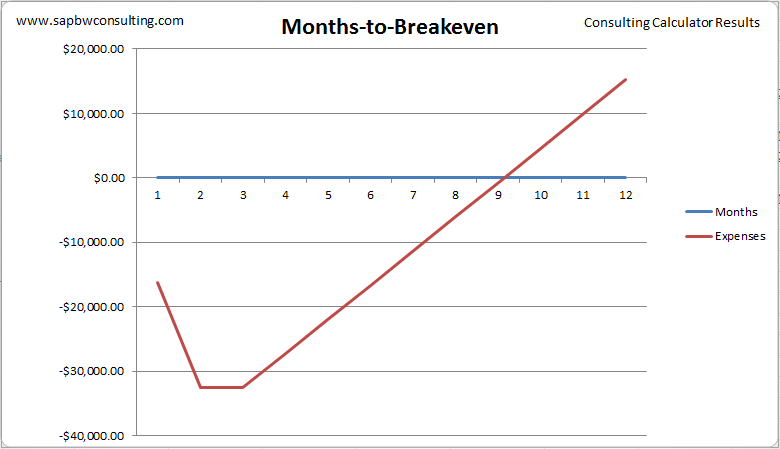

Months-to-Breakeven Chart

The butterfly chart above shows we don't have any positive cash flow till the beginning of month 4.

If the project ends before 8 months, then we lose $5,317 of our own personal savings for each month that is less than the 8 month breakeven point.

To be truly equivalent we need a guaranteed 18-month project to be on-par with our little $43/hr job.

.png?width=669&height=145&name=Cast%20Study%201%20results%20bottom%20060817(1).png)

You have to look at both

Income (take-home pay) and Cash Flows (out-of-pocket)

to evaluate a job offer completely.

This person has take-home pay of $17,576 per month but expenses of $16,024 per month out-of-pocket. So the breakeven point is many months (21) into the future. But if the contract is only for 6 months, this person will go bankrupt. When the monies involved are this big, any small mistake can be detrimental.

This was a real job offer I received. I turned it down.

Summary Conclusions:

For this All Inclusive job scenario, here is what the Consulting Calculator is telling us about this Hot New Job Offer.

These values are all read directly from the Consulting Calculator.

This is what you need to tell the Recruiter on the phone when they say "Hi what's your rate?"

(we recommend you bookmark the calculator and keep it open at all times when you are actively looking for that next consulting gig):

1) "All Inclusive Rate / hr": $ 135.14 per hour

2) "Yearly Rate": $ 259,468.80 per year

3) Months to Breakeven: 8 Months

And if the recruiter says "That's too high"; that's ok, anything less and you would have lost a lot of money but the recruiter would have made money.

And when they ask "can you come down a little lower?" you can confidently tell them "I could come down to $127 per hour, but at that rate, I still have $10-12,000 of expenses to pay each month, and at $127 per hour I am only breaking even on the expenses and not actually earning any money for myself.

My benefit is zero.

So what is the point of taking this job if I am going to be working without earning a profit?".

And if the recruiter says "ok, $135 per hour, all-inclusive", then you just put an easy $8/hr spendable money in your pocket that you never had before. Oh by the way $8/hr is just federal minimum wage, same as you can earn down the street in a clothing boutique.

That is the easiest money you will ever make.

Remember, even if the consultant labor rate was just $1/hr or $8/day, there is still $14,806 of travel related expenses ($92.53 / hr in expenses) that have to be paid and cannot be outsourced, off shored or negotiated away because these expenses are set by the hotel, airline and rental car companies and are totally beyond the consultant's control.

And that is why we created The Consulting Calculator, to help you negotiate a fair deal.

You may have other job offer scenarios you want to evaluate or model. To try our numbers from this example or to run the Consulting Calculator yourself, just click this button:

Please leave comments. Let us know how the calculator has worked out for you personally and share this with all your consulting and Recruiter friends.

Tip: If they won't pay expenses "Always Ask: What expenses can you pay?" or "What corporate deals can you get me on hotel or car rentals or airfare?"

14 Remote SAP Consulting Mistakes You Don't Know You're Making

Thanks

.png?width=669&name=Turn%20Something%20like%20this%20into%20something%20like%20this%20053117(7).png)

.png?width=320&name=What%20the%20consulting%20calculator%20Sees%20071217(2).png)