Have you ever had to prepare a project investment proposal?

If so, then you know that one of the most common ways to evaluate two alternative investments is to compare the NPV or Net Present Value of two or more investment alternatives.

Today’s world is upside down

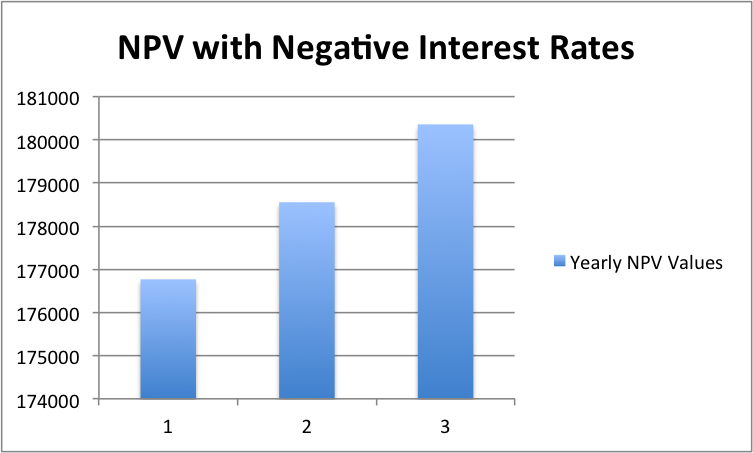

Recently, while helping a client develop a NPV based evaluation of two projects, I was asked what about the impact of negative interest rates on my recommendations. Hadn’t really thought of that, so I first prepared my NPV spreadsheet and used a spread of interest rates from 1% to 20%. Nothing out of the ordinary there, as you can see from the chart below, where I used 1%.

Typical NPV Pattern

As expected, in this scenario, the NPV was greater for the financial returns generated in the early years versus the later years.

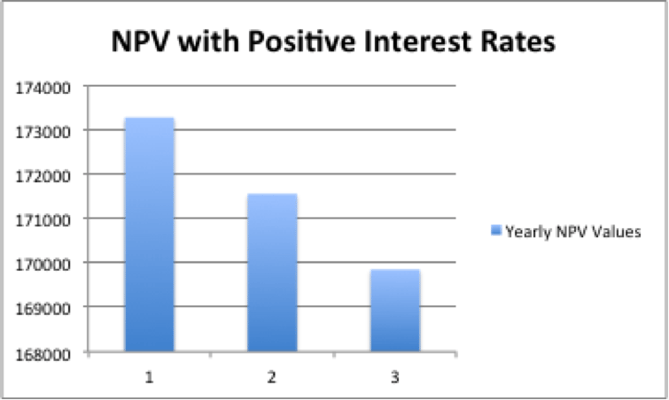

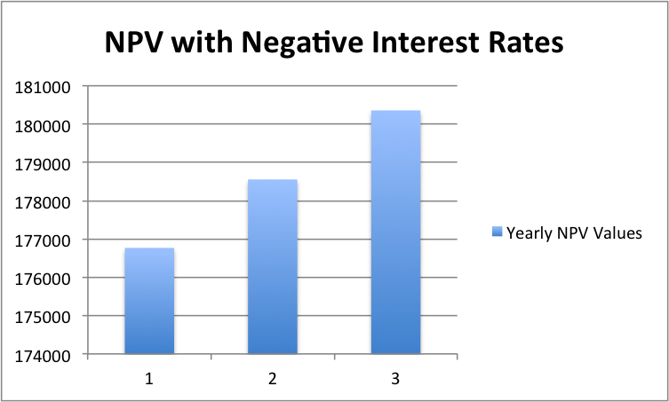

But then I swapped the 1% interest rate for -1% interest rate.

In this scenario, at -1% interest, the payoff is completely reversed.

How will investment behavior be impacted by this scenario?

As you can see, this turns the traditional investment analysis results upside down. I am still running various scenarios through my NPV calculator but the result seems consistent at all interest rates and time variation combinations.

Negative Interest Rates Impact On Project Investments

What can you conclude regarding the impact this is having on companies that are deciding on project investments, at least if they use NPV as part of their decision criteria?

- Virtually all projects will pay off much later in their lifecycle in a Negative Interest Rate environment

- The greater the negative interest rate, the greater the payoff is later in the project lifecycle (when the expected annual benefits are fairly steady)

- If you need quick payoffs, any project whose payoff is further in the future will not make the cut in all likelihood.

- There will be extreme pressure to capture the benefits in the first year (or earlier) of a project. If you play with the NPV template we provide, by adjusting payoffs up or down, you get some very dramatic swings in the NPV values when you use negative interest rates.

- Projects that are sold on ‘long term savings or accrued benefits’ will be very difficult to sell.

- From a project risk analysis perspective, those projects whose payoff is far in the future, and in this case, the future is not all that far out, will be at an extreme disadvantage.

- This risk averseness will cause short-termism to become extreme. Within the world of IT Investments, large multi-year implementations put everybody at risk. Instead, multiple short term, quick (but not necessarily high) payback projects become the norm.

- If you’re in sales (and if you're in business, you're in sales), you’re going to have to be able to work with your prospects on a much deeper level in order to get real customer data in order to produce valid business cases. This can be a real challenge, especially early in the sales cycle, when you may not yet have either the trust of your customer nor very good data about their operations. It also means greater expense when developing business cases, whether it is for complex ERP systems or Inbound Marketing Software.

- At a more general level, most internal systems within a company will not be configured to handle negative interest rates. Within any company, almost no one will think this affects them. They would be wrong. Directly or indirectly, it will affect their ability to progress.

- This will slow innovation, as it will now take much longer to get investment dollars approved. This will be especially true for riskier investments with questionable payback.

- Smaller companies will find it much more difficult to obtain financing.

This last point is a critical issue and can be seen throughout the economies of the world, where more than 7 trillion dollars of government debt is already in negative territory.

Economic Vapor Lock

In those economies where the government has decided to push interest rates into negative territory in order to stimulate the domestic economy, we can see that the opposite will be the result. When companies operating in those same negative interest rate economies run their NPV calculations, companies will see that it is not a good time to invest. The result of negative interest rates and upside down NPV analysis will results in an Economic Vapor Lock where nothing happens and nothing moves, the exact opposite of what the central bank was hoping for.

The Deflation Dragon

This is the stated reason a growing number of central banks have gone negative. But it has led to:

- Low growth,

- Anemic business investment,

- Risk averseness.

For most of us, this seems like a distant, esoteric subject. But it has consequences beyond low mortgage rates and asset bubbles. It means businesses have a hard time borrowing money, and an even tougher time finding projects that make sense to invest in. That makes it tougher for every business that sells to other businesses.

Present Value Calculator

If you just want to do a quick Present Value calculation, I've built this simple calculator for just that purpose. It won't handle negative interest rates, yet. So you still need to grab the downloadable version, which will.

People Who Read This Also Read

- Learn What Tools To Use To Investigate IS-Mill Functionality

- BusinessObjects Explorer Best Practices