Cutthroat competition is a given in the business landscape, but making it to the top requires laser-like focus on your industry's nuances and a masterful plan of attack. It's like a game of chess; you must think several moves ahead. You can't fly blind - you need tools that provide clear, actionable insights to guide your strategy. As a certified Kaplan-Norton Balanced Scorecard Consultant, I’ve seen firsthand how a Five Forces Model analysis helps shape winning strategies and contributes to a comprehensive strategic management process. It provides a proven strategic analysis framework.

Imagine a new restaurant opening up with no real plan other than good food. Anyone can be passionate about cooking, but a restaurant's success depends on more than just the temptation of its dishes - so don't count on taste buds alone. They might be surprised (and disappointed.) to quickly learn that competition for customers, negotiating with suppliers, or even finding suitable locations, can quickly derail their delicious endeavor.

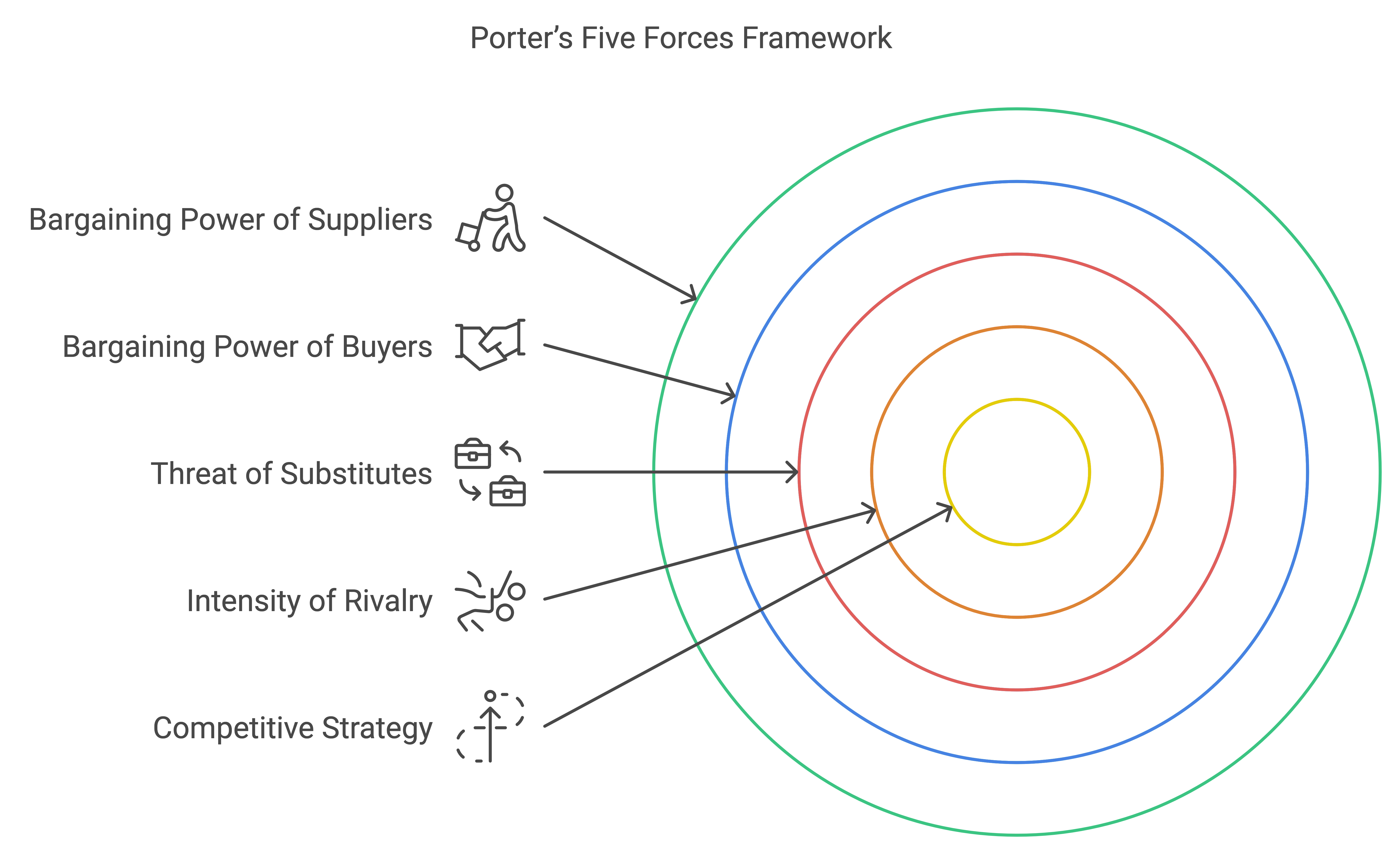

That’s where the power of the Five Forces Model comes in. Originally developed by Harvard Business School professor Michael E. Porter in 1979, this model acts like an x-ray, allowing you to peer into the inner workings of your industry.

Whenever I work with clients to build their Balanced Scorecards, this method always seems to clarify things and help us identify the best strategy. Forget following the crowd – use your newfound market insights to blaze your own trail and craft a winning game plan that sets you apart. It's analysis time - bring out the microscope!

Industry Rivalry

Imagine you're launching a new energy drink. You walk into a crowded convenience store, every shelf stacked with bright, flashy cans. Each drink is vying for the customer's attention and their hard-earned cash. That's Industry Rivalry, your first force.

Competition insiders gauge the temperatures of rival firms. They are always thinking of ways to get a competitive advantage. You need to know who you’re up against, how similar your offerings are, and how easily a customer could switch to a competitor. In industries where costs are largely fixed, companies operate on a knife's edge against many competitive forces. Try to maintain sales volume by cutting prices, and they may unwittingly provoke a price war that spreads like wildfire, hurting everyone in its path.

Key factors to watch here:

- Competitors: How many competitors are there, and how big are they?

- Industry Competition: Is your industry flooded with companies all offering practically the same thing?

- Market Changes: How fast is the market growing (or shrinking)? A shrinking market can intensify competition as companies scramble for a piece of the pie.

Understanding this force requires thorough market research, including attending industry events, studying customer feedback (think online reviews.), and carefully scrutinizing your competitor’s offerings. Listen, the truth is that information is the ultimate superpower.

The Threat of New Entrants

Let’s stick with the energy drink example. Let's say a trendy new brand bursts onto the scene, racking up rave reviews for its unique flavor and eco-conscious packaging. That, my friend, is the Threat of New Entrants. How easy is it for newcomers to muscle their way into the marketplace? Your long-term plans hang in the balance, and the answer will significantly shape their direction.

Here are the hurdles they face (or lack):

- High start-up costs (that swanky packaging doesn’t come cheap.), regulatory roadblocks, and limited access to distribution channels can act as barriers, keeping the playing field less crowded. Think of the aerospace or pharmaceutical industries; those require massive capital investments.

- Low barriers to entry, like the ones often seen with food trucks or app development, can open the door to lots of competition. Before you can make sense of an industry, you need to know its capital requirements - it's like reading a roadmap to avoid costly detours.

- At the forefront, this driving force brings attention to the significance of the last time you recommended a brand to a friend or family member. You weren't just suggesting a product - you were vouching for the entire brand experience. That level of trust is what drives brand loyalty. With a steady stream of innovations, you throw up a roadblock for new entrants trying to siphon off your market share. New businesses face an uphill battle trying to win over customers when established firms have a head start with their recognized brands and loyal followings.

Bargaining Power of Suppliers

Let’s face it, you need those raw ingredients to craft your perfect energy drink concoction, right? Their pulse is on the supplies that matter most. Their bargaining power comes into play, big time. What happens when only a few suppliers control access to those must-have ingredients, and they decide to raise prices? This ripple effect can hit your bottom line hard, making your carefully crafted budgets go out the window.

Ever heard of "A Taxonomy of Moats"? Supplier power becomes a lot more relatable when you consider this concept side by side. Imagine trying to create a tech company reliant on a specific microchip, but only a couple of companies in the world produce it, giving them a powerful “moat”. Suddenly, you're at their mercy in negotiations.

Here are a few factors that affect Supplier Power:

- A limited number of suppliers, offering rare or hard-to-substitute ingredients or materials, translates into more bargaining power on their end. Industries with high entry barriers often face powerful suppliers due to the limited alternatives available.

- Don’t underestimate the power of building strong relationships with your suppliers, paying your invoices on time (always a good practice.), and having backup options, just in case. Diversification helps mitigate this risk by not putting all your eggs in one basket.

- Vertical integration, like owning part or all of your supply chain, can be a smart way to gain more control, but that’s a bigger strategic move that depends on your resources. Take industries where suppliers dominate, and you'll find a common thread: they hold substantial sway, enough to dramatically tilt the scales.

Bargaining Power of Buyers

Flip the script and think about a massive retailer like Walmart (yeah, the one with everything), or even a giant online marketplace like Amazon. The prices they pay are heavily swayed by their customer base. These retail behemoths buy massive quantities, so they can demand rock-bottom prices from suppliers who are practically tripping over themselves to snag those huge orders.

In the Five Forces framework, customers hold significant sway, pushing companies to lower prices or upgrade their offerings to meet higher expectations. Think about those savvy consumers out there who relentlessly compare prices online or who are loyal to a particular brand. If customers can easily switch to a competitor's products or services, they have high bargaining power.

Factors at play in Buyer Power:

- Are your buyers primarily large corporations or individual consumers? Larger buyers usually have more muscle in negotiations, especially when it comes to demanding favorable terms or volume discounts.

- Switching costs come into play. Switching costs refers to how much effort a buyer has to make when going with a different product or service. The lower the switching cost, the more power buyers have.

- Hold the purse strings tight and you'll discover a hidden ace up your sleeve - buyer power. What happens when you know exactly what you want and aren't afraid to demand it? Loyalty doesn't grow overnight, but it blossoms when customers feel seen and heard. A great customer service experience or exclusive deals and loyalty programs help tip the balance in your favor and prevent customer churn. Perception is everything; make your offerings worth more in customers' eyes, and they'll be less likely to haggle over price.

Threat of Substitutes

Remember those energy drinks we talked about earlier? Now imagine consumers reaching for sparkling water, herbal teas, or even those fancy, caffeinated sparkling waters, instead. Those are your substitutes. These products, although potentially in different industries, can fulfill the same needs as yours, often in a less expensive or more convenient manner.

In his framework for strategic analysis, this is where understanding the Threat of Substitutes can really make a difference. It's crucial to remember this isn’t just about having slightly cheaper alternatives, but about factors like changing consumer preferences (healthy living is trending.). Think about how ride-sharing services like Uber and Lyft totally upended the traditional taxi industry by providing an innovative, more convenient (and for many, less expensive) solution. The easier it is for customers to switch to a substitute, the higher the threat.

Managing this force involves constant vigilance:

- Maintaining a hawk-like vigilance, we track their every move. Keeping pace with your industry's rapid-fire evolution demands more than just awareness - it requires an innate sense of how market forces, consumer needs, and innovative breakthroughs intersect. Perfecting your offerings means one thing: you get to dictate the pace in your market. For instance, if you're in the business of selling print newspapers, the rise of online news sources represents a significant threat of substitutes.

- Prioritize building strong brand identities . A strong brand identity is like a protective armor that fends off competitors, especially when customers develop a strong emotional bond with your products or your sales pitch resonates deeply with them. With a solid brand in place, rivals will have a much harder time trying to muscle in on your territory.

- Porter's article, How Competitive Forces Shape Strategy, published in the prestigious Harvard Business Review in 1979, remains relevant. With each new insight, he layered on more depth and texture, culminating in a panoramic view of the competitive landscape that strategic analysts could practically sink their teeth into.

The time has come to bring everything full circle, pulling together the threads of our conversation into a neat and tidy bow.

From Solo Entrepreneurs to multinational moguls, business leaders agree: Michael Porter's Five Forces Model is the ace up your sleeve when it comes to decoding the competitive environment. By examining each of the five forces in detail —industry rivalry, the threat of new entrants, supplier power, buyer power, and the threat of substitutes— you're not just reacting; you are strategically positioning yourself for success.

FAQs about Five Forces Model

What is the 5 forces model?

Porter's Five Forces framework peers into the industry structure, illuminating the multiple forces shaping the playing field: competition among established players, fresh entrants, supply chain dependents, demanding customers, and game-changing substitutes. The Five Forces framework doesn't just look at existing competitors, it takes a holistic view of the industry structure. Organizations that crack the code on power dynamics get a clear edge in staying ahead of the curve and crafting winning strategies that last. It's time to face the facts: Stay one step ahead by mapping out the subtle factors driving your competitors' decisions.

What is the five forces factor model?

The five forces factor model looks at the specific elements influencing each competitive force. For instance, within "Bargaining Power of Suppliers", it would analyze factors like the concentration of suppliers, availability of substitutes, and the importance of the supplier's product to the industry. By grasping the inner workings of stakeholder groups - their motivations, strengths, and weaknesses - you'll be empowered to make nuanced, savvy decisions that hit the mark.

What is a Porter's 5 forces analysis example?

Take the airline industry: Intense rivalry among airlines, high supplier power due to limited aircraft manufacturers, and significant buyer power from price-sensitive travelers all contribute to an industry often squeezed for profits. Let's take a look at another industry, streaming services. The threat of new entrants is relatively low due to the high costs of content acquisition. However, the bargaining power of suppliers, particularly those who own the rights to popular shows and movies, is very high.

What is the main objective of the 5 forces model?

In the rough-and-tumble world of business, foresight is everything; this powerful resource furnishes companies with a bird's-eye view of their industry, helps them separate opportunity from obstacle, and charts a path to high profits and higher standing. The model is especially beneficial during strategic planning, M&A considerations, and when anticipating market shifts or disruptions. Finding the perfect industry is a pipe dream. What matters is getting a grip on the local climate and adjusting your firm's approach accordingly.

What does Porter's Five Forces Model Help Firms Do?

The Five Forces Model, developed by Michael Porter, helps firms analyze and understand various aspects of their competitive environment. Specifically, it helps firms to:

-

Identify Industry Attractiveness

The model assesses the profitability potential of an industry by examining the competitive forces at play. This helps firms decide whether to enter or exit a particular market. -

Evaluate Competitive Forces

It provides insights into the five key forces—competitive rivalry, supplier power, buyer power, threat of new entrants, and threat of substitutes—helping firms understand the dynamics shaping their industry. -

Formulate Strategic Responses

By identifying the strengths and weaknesses of each force, firms can develop strategies to strengthen their competitive position, such as improving cost efficiency, differentiating products, or negotiating better terms with suppliers and buyers. -

Anticipate Market Changes

The model helps predict how changes in one or more forces, such as the emergence of new competitors or shifts in consumer preferences, might impact the industry landscape. -

Gain a Competitive Edge

Firms can leverage the insights gained from the Five Forces analysis to exploit opportunities, mitigate risks, and build sustainable competitive advantages. -

Support Long-Term Strategic Planning

It provides a structured framework for analyzing industries, which supports better decision-making for long-term growth and success.

By leveraging the Five Forces Model, firms can better understand their industry, adapt to changes, and position themselves for success in a competitive marketplace.

Balanced Scorecard Consulting

Our firm offers comprehensive Balanced Scorecard Consulting and the ability to develop the data warehouse you need to support your strategy management system. Our team are experts at looking at the competitive landscape using Porter's Five Forces Model and using the insight from this exercise in developing a winning business strategy.

About SAP BW Consulting, Inc.

At SAP BW Consulting, Inc., our team of MBA consultants, including those with quantitative and strategic expertise, specializes in helping businesses develop and execute data-driven strategies that drive growth and profitability. Leveraging tools like the Balanced Scorecard and Porter's Five Forces model, we provide actionable insights and tailored consulting services to align your organization’s operations with its strategic objectives. Whether you’re seeking to improve decision-making, refine competitive strategies, or optimize performance metrics, we offer the expertise to transform your vision into measurable results. Book a meeting today to learn how we can support your success.

Beyond SAP, we are certified HubSpot Marketing and Sales Partners, helping businesses drive growth through the HubSpot Inbound Methodology. We also offer Salesforce consulting to optimize complex environments that integrate SAP, HubSpot, and Salesforce.

In addition, we provide Balanced Scorecard consulting, helping companies design and implement effective strategies to improve performance and achieve long-term success.

If you're ready to elevate your SAP operations, marketing, or strategy, book a meeting with us today.