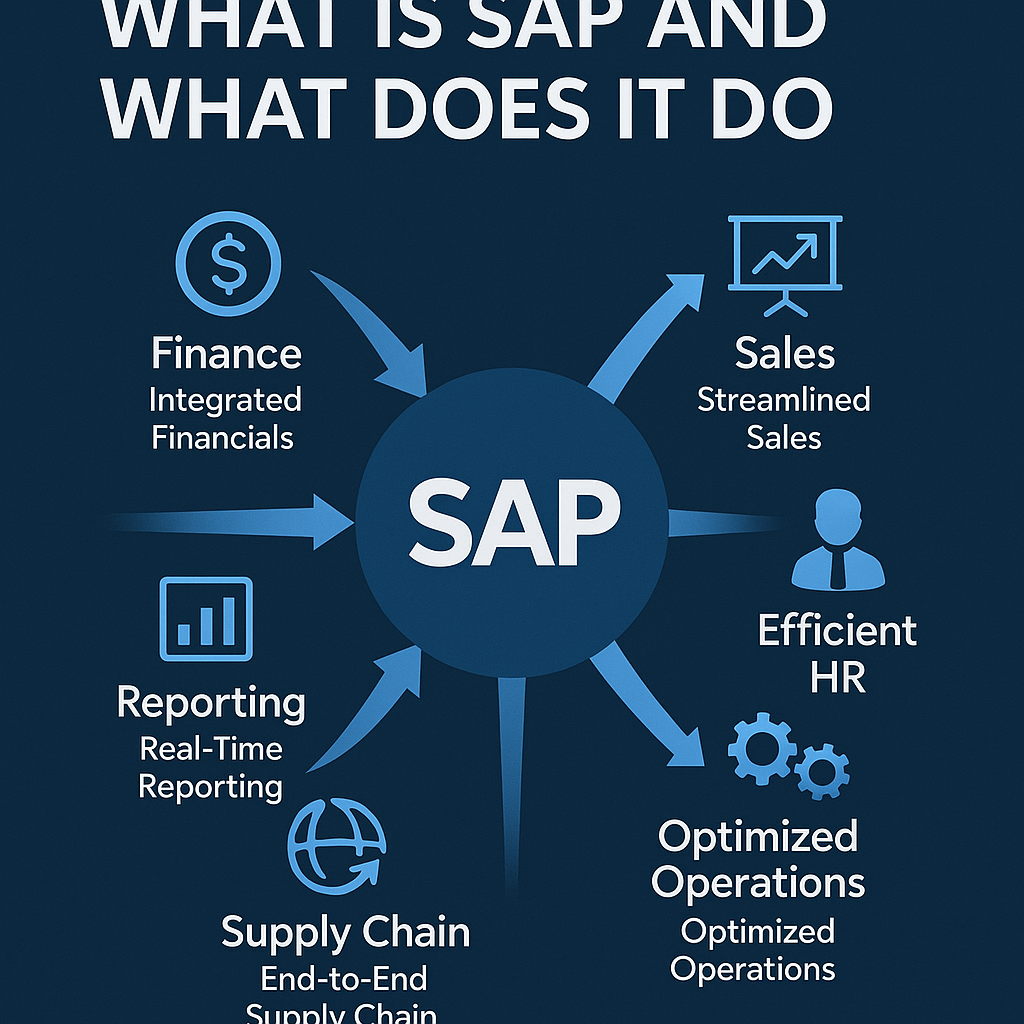

Venture capitalists and private equity firms constantly look for ways to maximize their portfolio value. A powerful tool that is gaining significant attention is SAP. This enterprise resource planning (ERP) system is becoming a major factor in high-stakes investing, providing a clear strategic advantage.

Understanding how to leverage SAP for venture capital is no longer optional for firms aiming for top-tier returns. It provides a foundation for growth, transparency, and operational excellence. This shift impacts everything from due diligence to the final exit strategy.

Need Strategic Level Advice on getting maximum value from your SAP System. Then get our CEO's Guide to SAP

Why SAP Matters to Venture Capitalists

For any investment, solid data is the most important asset. SAP provides a level of financial transparency that gives investors confidence. It offers standardized, auditable data across entire portfolios, moving beyond simple reporting.

This standardization is fundamental for accurate analysis. It allows VC firms to compare different investments directly, even when their portfolio companies operate in diverse industries. This eliminates data silos and complex spreadsheets, making financial review straightforward.

This clarity is one reason investors favor companies running on SAP. They can trust the financial information presented. The integrity of the data supports better decision-making from the very beginning of the investment process.

The 'SAP Cram Down' Strategy in Private Equity

The 'SAP Cram Down' is a strategy gaining traction in private equity. The concept involves mandating SAP across newly acquired portfolio companies. While it may seem forceful, the benefits are substantial and often lead to rapid value creation.

This approach unifies financial reporting and business processes across the board. It reduces operational risk and gives investors a comprehensive view of their entire portfolio. Imagine consolidated dashboards and common KPIs across all your investments; that is what this strategy delivers.

Of course, implementing such business solutions change can present challenges like staff turnover or resistance. However, with strong executive leadership and a clear vision, the long-term payoff outweighs the short-term friction. The result is a more cohesive and manageable group of business units.

SAP as a Turnaround Tool

For companies facing financial trouble, SAP solutions can be a critical part of the recovery plan. Many firms in bankruptcy use SAP to attract new investors. Its implementation signals to potential buyers and banks that the company is serious about its turnaround.

The SAP 'go-live' milestone often happens as a company emerges from bankruptcy or completes a recapitalization. It serves as a powerful symbol of a new beginning and renewed financial discipline. This renewed structure often involves a modern enterprise architecture based on a SAP Global Template.

SAP helps the business unit get back on track by providing clear insights into business operations. The improved control over finances and the supply chain is attractive to investors looking for a stable foundation for future growth. The system supports better business practices from day one.

From Portfolio Management to Exit Strategy

SAP is a strategic asset throughout the entire investment lifecycle. From the initial valuation of a potential deal to the final exit strategy, SAP financials streamline every step. The platform supports better portfolio-wide decisions through data-driven and agile processes.

Capital allocation choices are backed by real-time insights from a reliable technology platform. When it is time to sell, companies running on SAP often attract better offers and higher valuations. The organized data and processes make the company a more appealing asset for acquisition, especially by larger SAP customers.

The benefits are tangible and significant. They include faster post-merger integration, easier benchmarking across portfolio companies, and improved investor confidence. These are real outcomes that a well-implemented SAP system delivers, proving its value far beyond basic accounting.

The Sapphire Ventures Model

To see SAP's connection to venture capital in action, look no further than Sapphire Ventures. As SAP's corporate venture arm, this venture firm provides a clear example of how a major enterprise software company engages with the startup world. Located in Palo Alto, Sapphire Ventures operates independently while leveraging its relationship with SAP.

Led by Managing Director Nino Marakovic, the ventures team focuses on high-growth technology companies. Their investment strategy is not just about providing capital. They also connect their ventures portfolio companies with the vast SAP ecosystem, opening doors to a global network of SAP customers and partners.

This approach gives their portfolio company a distinct advantage. The venture funds invest in businesses that can benefit from SAP's global reach, supporting everything from international expansion to navigating complex global trade regulations. Success stories from the ventures portfolio highlight how this symbiotic relationship drives rapid expansion.

Lessons from the Trenches

After decades of SAP consulting, certain patterns become clear. Here are some key takeaways for investors considering this platform for their portfolio:

- SAP is a non-negotiable standard for financial trust and comparability across multiple business units.

- Implementing SAP across new acquisitions can accelerate ROI by standardizing business processes quickly.

- Consistent financials from SAP enable rapid, portfolio-wide benchmarking and performance analysis.

- Companies with a solid SAP enterprise system often get higher valuations at exit from strategic buyers.

The formula is straightforward: combining SAP with strong leadership leads to measurable value creation. This is a combination that smart VC firms and private equity investors are using to their advantage. It creates a common ground for evaluating performance and identifying areas for improvement.

SAP's Role in the Investment Cycle

Let's examine how SAP adds value at each stage of the venture capital journey. Its impact is felt from the moment a deal is sourced until the final exit. The platform becomes an integral part of the investment's core business functions.

| Investment Stage | SAP's Impact |

|---|---|

| Deal Sourcing | Identifies companies with strong financial foundations and scalable business operations. |

| Due Diligence | Provides clear, auditable financial data, which reduces risk and speeds up the process. |

| Implementation | Standardizes processes and systems across the ventures portfolio. |

| Growth Phase | Enables data-driven decision-making, international expansion, and scalability. |

| Exit | Enhances company valuation and attracts quality buyers, including existing SAP customers. |

At each step, SAP provides the infrastructure for growth, transparency, and value creation. A company that is already running SAP presents a much cleaner and more attractive investment opportunity. It shows a commitment to operational maturity.

Overcoming Implementation Challenges

Implementing a cloud ERP like SAP is a significant project. It can strain resources and test the patience of any management team. For venture capitalists, the long-term strategic benefits must be weighed against these short-term hurdles.

Common challenges include resistance to change, difficult data migrations, and initial dips in productivity. A strategic approach is the best way to deploy SAP. Finding the right solution provider or SAP expert from the services community is a critical first step.

Here are some tips for a smoother process:

- Start with a clear vision and communicate it consistently across the organization.

- Invest in thorough training and change management to get staff on board.

- Choose experienced implementation experts who understand your industry and business goals.

- Set realistic timelines and expectations to avoid burnout and frustration.

- Consider application management services post-launch to maintain system health and user adoption.

The goal is to transform how portfolio companies operate and create value, not just install new business software. A successful implementation can achieve a fast time to value. The active SAP Community is also a valuable resource for troubleshooting and sharing best practices.

The Future of SAP in Venture Capital

Looking ahead, the role of SAP in the venture capital space is set to expand. Emerging technologies like artificial intelligence and machine learning are being integrated into the SAP Business Technology Platform (SAP BTP). This integration is opening new possibilities for investors and their portfolio companies.

Imagine predictive analytics that can forecast market trends or identify supply chain risks across an entire portfolio. Think about real-time risk assessments that support split-second investment decisions. These advanced capabilities are the next frontier for investors who use the public cloud offerings from SAP effectively.

Furthermore, as Environmental, Social, and Governance (ESG) factors become more important, SAP's reporting capabilities will be invaluable. The system can help VC firms track and report on sustainability metrics and corporate social responsibility initiatives. This commitment to social responsibility is increasingly a focus for both investment programs and thought leaders in the industry.

Conclusion

SAP for venture capital is more than a simple tool; it is a powerful strategic asset. It delivers the financial transparency, operational alignment, and portfolio-wide insights that modern investors require. From speeding up due diligence to boosting exit valuations, SAP is changing how VC firms create and capture value for their software companies and other investments.

In the high-stakes environment of venture capital, information is power. SAP provides the power to make smarter decisions, drive growth across a global supply chain, and deliver better returns. It is about having the right data, at the right time, in the right format, a true advantage that SAP helps achieve.

As the business world becomes more data-driven, firms that leverage SAP will have a significant edge. They will move faster, see clearer, and invest smarter. In the competitive game of venture capital, this is not just an advantage—it is what it takes to lead the pack.

Get a SAP Value Realization Roadmap.

We are a SAP implementation and support partner. We can implement SAP in your business from 'greenfield' all the way to performing global roll-outs. With our deep Industry Expertise, we can help you uncover hidden value within your SAP system and drive your business to levels of profitability. Please our book a meeting service to get started.