Imagine owning two very different companies. One makes widgets, and the other offers consulting services. You need to know which one is the better investment for your next dollar, but how can you possibly compare them? It feels like trying to judge a race between an apple and an orange.

This is a daily problem for venture capital firms and executives managing diverse portfolios. Baked-in assumptions and inconsistent financial reports muddy the waters. The right kind of SAP business benchmarking clears this confusion, giving you a common language to measure what truly matters.

For more than 27 years, I have seen this play out in boardrooms around the world. With the right system, what seems complex becomes clear. This powerful approach to SAP business benchmarking turns dissimilar data into direct, actionable insights.

Need Strategic Level Advice on getting maximum value from your SAP System. Then get our CEO's Guide to SAP

Why Cross-Company Comparison Is So Hard Without SAP

Trying to compare businesses without a unified system is a recipe for frustration. You're not looking at facts; you're often looking at cleverly presented fiction. Each company speaks its own financial dialect, making a true comparison nearly impossible, especially for earnings quality, among many key insights.

One company might follow U.S. GAAP standards for accounting, while another might use IFRS. These are not minor differences; they fundamentally change how revenue and costs are reported, as detailed by accounting bodies like the IFRS Foundation. This creates a huge barrier to a clear, consolidated view of your entire SAP enterprise.

Then you have Key Performance Indicators, or KPIs. Everyone tracks them, but the definitions are rarely consistent across a portfolio. One CFO's Return on Investment (ROI) is another's Return on Net Assets Invested (RONAI), and they calculate them differently. Without a single standard, you are not comparing performance but rather interpretations.

This problem extends beyond finance into operations. A core business process like "order-to-cash" can have dozens of variations in execution and measurement between companies. This lack of a standardized SAP business process makes it difficult to identify which company is truly more efficient.

Manually combining spreadsheets from different businesses only worsens the situation. The process is slow, tedious, and filled with human errors. Numbers get mistyped, formulas break, and data gets distorted, leading you to make decisions based on flawed information from a disconnected SAP ERP system.

My SAP Business Benchmarking Philosophy

After decades of work and dozens of projects, I see SAP business benchmarking not just as a tool, but as a philosophy. It is about creating a single, undisputed source of truth. This foundation lets you stop guessing and start making strategic moves with confidence.

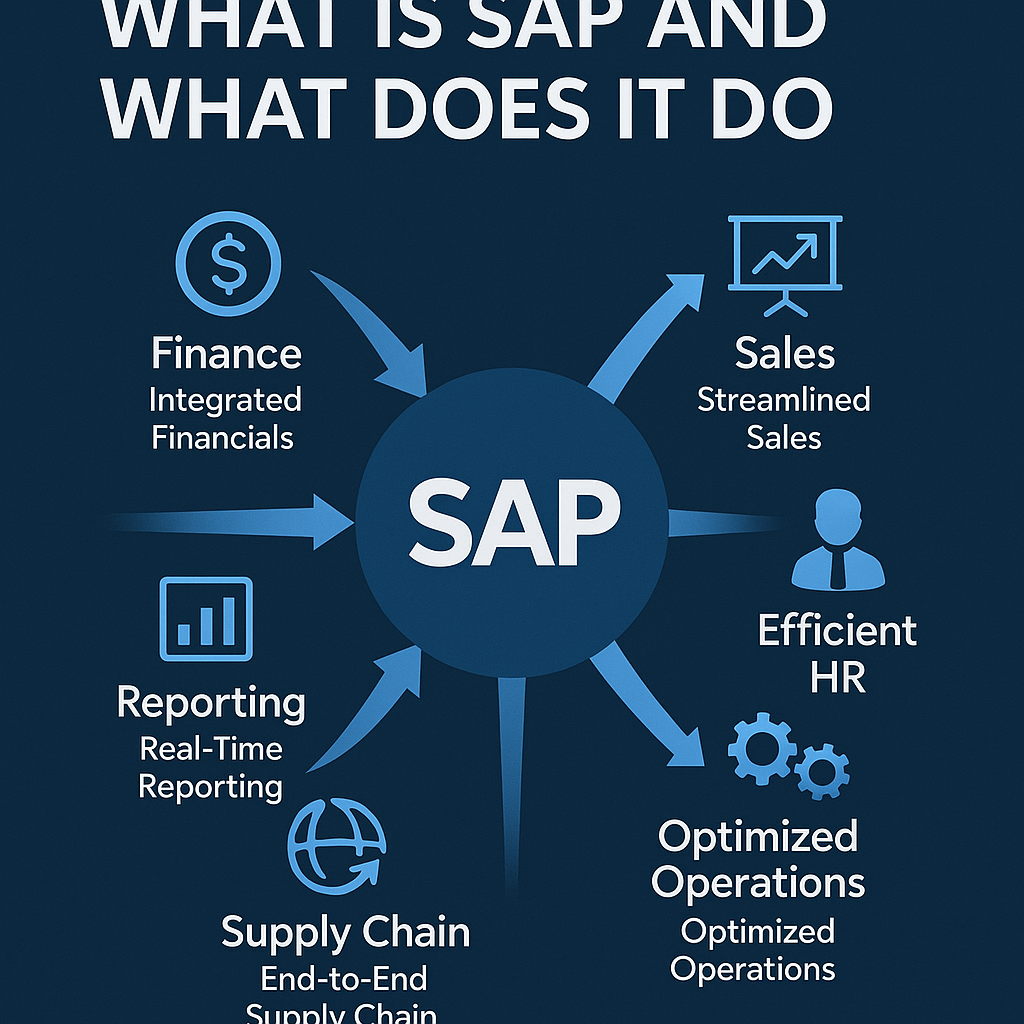

The magic starts by standardizing all your financial and operational data across every SAP application. SAP gives everyone a common chart of accounts and unified master data. This means that a 'sale' is recorded the same way everywhere, and 'cost of goods sold' means the exact same thing for every company.

This consistency is powered by modern platforms like SAP HANA. The in-memory database of SAP HANA processes massive amounts of data in real time, dramatically improving the response time for generating insights. You are no longer waiting days for batch reports; you are getting answers instantly.

Once your data is consistent, you can use powerful tools. SAP Value Engineering benchmarking tools, such as the SAP Value Lifecyle Management tool and the SAP Analytics Cloud, turn raw numbers into clear dashboards. You can see real-time performance across every business, finally enabling that true apples-to-apples comparison using a standard application benchmark.

Using SAP for Portfolio-Level Benchmarking

For VCs and private equity firms, this is a game-changer. They often implement SAP across all their subsidiary companies. Why? Because it lets them measure profitability and performance uniformly, cutting through the noise.

With centralized financials, trend analysis becomes simple. You can spot which companies are growing and which are struggling. You can compare gross margins across completely unrelated industries to see who is most efficient at turning revenue into profit.

For example, you could compare the purchasing efficiency of a manufacturing plant against the client acquisition cost of a software firm. While the operations are different, the financial discipline can be measured. Effective SAP portfolio management relies on this level of standardized data to work.

The benefits of a unified approach become even clearer when looking at specific operational areas. The SAP SD (Sales and Distribution) module allows for direct comparison of sales operations. Using an established SD benchmark, a holding company can analyze metrics like order fulfillment times or sales cycle lengths across its entire portfolio.

The table below illustrates the shift in capability.

| Feature | Manual Spreadsheet Method | SAP Unified Benchmarking |

|---|---|---|

| Data Source | Disparate, siloed systems | Single source of truth from SAP enterprise ERP |

| KPIs | Inconsistent definitions | Standardized, portfolio-wide metrics |

| Reporting | Manual, slow, error-prone | Automated, real-time dashboards (SAP Cloud) |

| Response Time | Days or weeks for insights | Near-instantaneous analysis (SAP HANA) |

| Business Process | Opaque and varied | Transparent and comparable |

| Data Center | Multiple on-premise locations | Centralized physical or SAP cloud infrastructure |

This concept of using SAP standard application benchmarks provides a powerful template for performance. By deploying a SAP standard application across the portfolio, investors establish a baseline for what "good" looks like. It is no longer a subjective measure but a data-backed one.

This is what having a "single source of truth" really means. It is not just a buzzword; it is a powerful asset. It allows for a level of strategic oversight that is impossible with disconnected systems, leveraging multiple application benchmarks for a complete picture.

How SAP Supports Smarter Investment Decisions

Clear, standardized data has a direct impact on your bottom line. It removes the guesswork from critical financial models. Your Net Present Value (NPV) and Discounted Cash Flow (DCF) analyses become far more accurate.

We've all seen investment proposals that seem too good to be true. They often are, thanks to those 'baked-in assumptions' I mentioned. A manager might create a rosy forecast to secure funding, but a standardized system running on a SAP standard exposes unrealistic projections. The data does not lie.

This is especially critical during due diligence for a new acquisition. By comparing the target company's data against your established standard application benchmarks, you can quickly assess its health. This process provides a clear application benchmark for evaluating performance before you invest a single dollar.

This leads to better resource allocation. Instead of overfunding an underperformer because its numbers looked good on a spreadsheet, you can direct capital to the companies with real potential. It helps you avoid starving a rising star while propping up a struggling division.

Ultimately, this makes optimizing your entire portfolio faster and more transparent. A study from MIT Sloan shows that data-driven decision-making improves company performance. SAP provides the backbone for that discipline.

Lessons Learned from 27+ Years in SAP Consulting

After being the project manager on about 38 projects, I've seen what works and what does not. The most successful investors I have worked with think of SAP as more than just software. They see it as a strategic asset for growth and clarity.

Here are some of the key takeaways for any CEO or investor:

- Benchmarking works across all industries. SAP gives you the financial and operational framework to compare completely different businesses. This lets you spot inefficiencies and share best practices across your portfolio.

- Portfolio-level KPIs mean smarter investments. When everyone uses the same metrics, you can make faster decisions about where to invest and when to exit. It takes the emotion out of difficult choices.

- Value Engineering tools reveal hidden opportunities. These tools help identify performance gaps and areas for improvement you would otherwise miss. Think of it as a roadmap to creating more value.

- Forcing standardization pays off. When a VC firm insists that new acquisitions adopt their SAP framework, it might seem tough initially. But this 'cram down' creates incredible long-term advantages in comparability and control.

- Transparency drives confidence. When your entire portfolio runs on a transparent, unified system, it boosts investor confidence. This can directly lead to higher valuations for your companies and your fund.

The CEO and Investor Takeaway

In today's competitive world, you cannot afford to fly blind. If you manage multiple businesses, you must have a way to compare their performance accurately. Otherwise, you are not managing; you are just guessing.

Think about SAP not as an expense, but as your business benchmarking engine. It gives you the clear, undisputed data needed to drive performance, creating solid SAP standard application benchmarks for your entire operation. After all, if you cannot truly compare your companies, you cannot possibly optimize them.

So ask yourself: Does your current system support true performance comparability across your entire portfolio? If the answer is no, it might be time to find one that does. Your future growth depends on it.

Conclusion

Comparing dissimilar businesses does not have to be a source of confusion and risk. It can become your greatest strategic advantage. By implementing a unified system, you can standardize data, normalize KPIs, and gain a crystal-clear view of your entire portfolio.

My experience has shown time and again that a structured approach to SAP business benchmarking separates top-performing investment funds from the rest. It replaces assumptions with facts and lets you turn complexity into clarity. This makes sure every dollar you invest is working as hard as possible to create long-term value.

Get a SAP Value Realization Roadmap.

We are a SAP implementation and support partner. We can implement SAP in your business from 'greenfield' all the way to performing global roll-outs. With our deep Industry Expertise, we can help you uncover hidden value within your SAP system and drive your business to levels of profitability. Please our book a meeting service to get started.