You know you need to check out the competition. It is one of those tasks that lingers on your to-do list, feeling both important and a little intimidating. My experience with hundreds of clients shows me that most people approach competitor research with the wrong mindset, making it feel like a huge, pointless chore.

They think it is about making a giant spreadsheet of every little thing a rival does. That is not the goal of a proper competitive analysis. True competitor research is much simpler and far more powerful.

It boils down to answering two fundamental questions about your place in the market. When you focus your efforts there, everything becomes clearer, and your marketing strategy gains purpose.

Inbound Marketing Assessment

This is part of a series blogs based on my book, "Know What You Sell", available on Amazon. Ultimately, we developed the Free Inbound Marketing Assessment Scorecard to help you decide how to develop, position and successfully market your product or service. It takes less than 2 minutes and you get a customized report based on your answers which you can use as roadmap through the ever changing world of marketing and sales.

So, Why Bother with Competitor Research?

It is a fair question. You are busy running your own business, so why spend precious time looking at others? Because ignoring your competitors is like driving with your eyes closed.

You might be heading in the right direction, but you have no idea what roadblocks or growth opportunities are just ahead. Good research gives you a map of the market landscape. This market analysis lets you see where your customers are and what they expect from the companies they do business with.

This process also shines a light on gaps in the market. Maybe every competitor focuses on large enterprises, creating a huge opening for you to serve small business owners. You will not find these golden opportunities to increase your market share without looking.

The Two Questions Your Competitor Research Must Answer

Over my 15 years in marketing, I have learned to filter out the noise. Forget tracking every social media post or price change. Instead, focus your entire competitor research process on answering two questions: "Can we win?" and "How do we lose?".

Everything you discover while you analyze competitors' activities should help you answer one of these two things. This approach keeps you focused on what truly matters for your strategic plan. It turns research from a passive activity into a strategic weapon.

Can We Win? Finding Your Edge

This question forces you to look for your distinct advantages. It is an optimistic but realistic search for what makes you better. Where can you genuinely beat the competition and gain a foothold with the target market you're targeting?

Start with the competitors products and services and how they compare to yours. Do you offer a feature they lack, or is your quality higher? Maybe your approach is just simpler and easier for the customer base to understand.

Then, look at their marketing and social media presence. Read their website copy, blogs, and their success stories to see how they present themselves. Is their message clear, or is it full of confusing jargon? Often, the company that communicates with the most clarity wins.

Do not forget to dig deeper into customer reviews on various social platforms. What do customers rave about? This is their perceived strength. If you can match it or find a weakness they complain about, you have found an opening to improve customer satisfaction.

How We Lose? Facing Your Weaknesses

This is the tougher question, and it requires honesty. Where are your main competitors beating you right now? Being blunt here is the fastest way to improve and avoid situations where you lose business.

Are their pricing strategies more attractive, or do they offer a free trial while you do not? Do they have a stronger brand that people know and trust? You have to ask these hard questions to understand the competitive landscape.

Maybe their customer support is legendary, with 24/7 availability, or their website is much faster. According to research from Portent, website conversion rates drop significantly with every extra second of load time. Look at these areas not as failures, but as your roadmap for improvement and identifying potential threats.

A Practical Guide to Competitor Research

Okay, theory is great, but how do you actually do this? You do not need a massive budget or a dedicated team for conducting competitive analysis. You just need a process and perhaps a good analysis tool.

Here is a straightforward plan to get the answers you need without getting overwhelmed. It is the same process my team and I use as a competitive analysis template. This competitor analysis helps you stay focused on action instead of just gathering data.

Step 1: Identify Your True Competitors

First, you need to know who you are up against, as it is not always obvious. A comprehensive market analysis helps identify competitors across different categories.

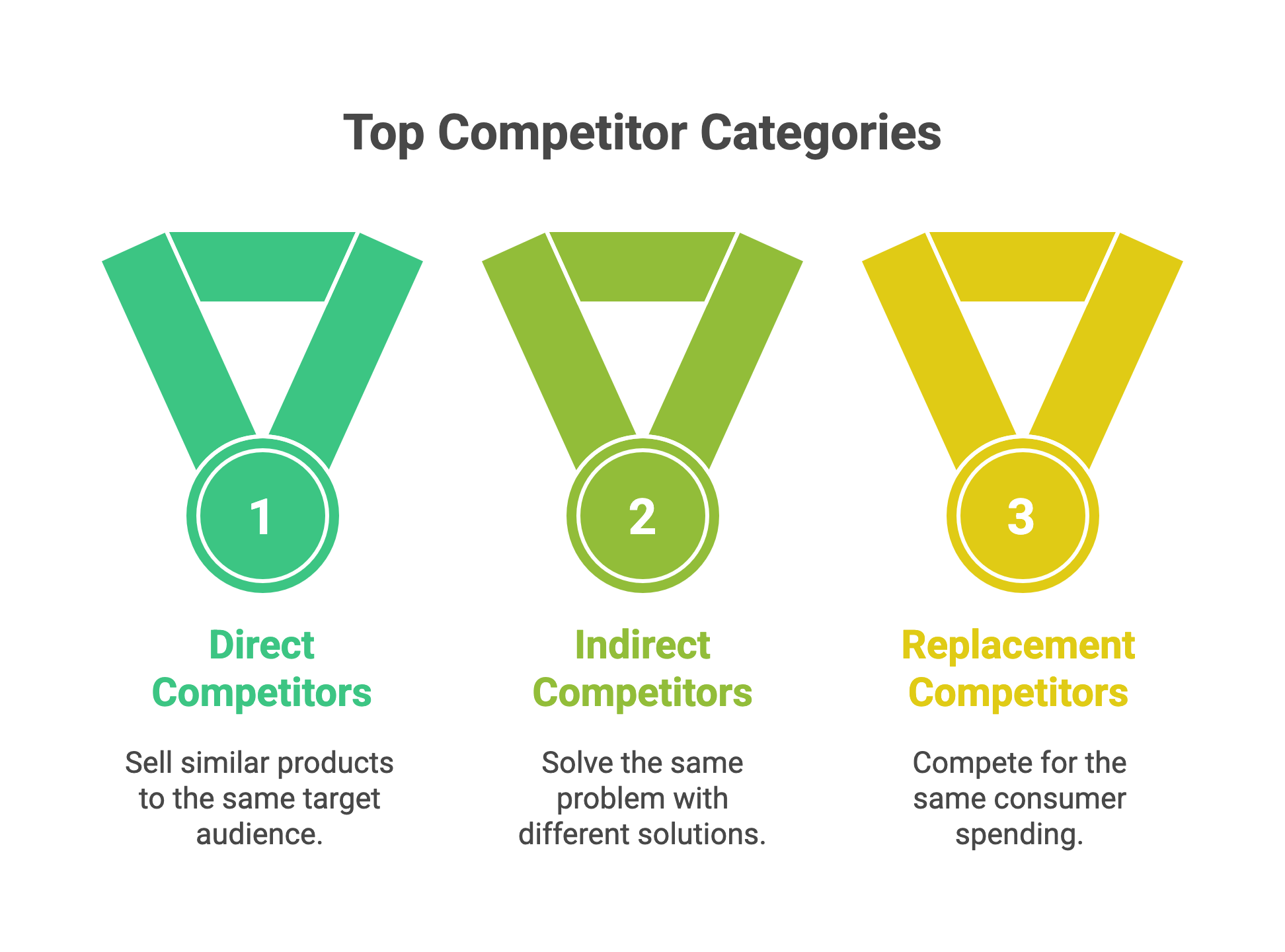

I recommend breaking them into three groups:

- Direct Competitors: These are the easiest to spot. They sell a similar product or service to the same target audience. For an SAP financial consultant, this would be other SAP financial consulting firms.

- Indirect Competitors: These businesses solve the same core problem but with a different solution. For instance, a company might choose an off-the-shelf accounting software instead of hiring a consultant to customize SAP. These indirect competitors are still vying for the same budget.

- Replacement Competitors: These are companies competing for the same consumer spending. A business might decide to hire an in-house accountant instead of paying for consulting services. They are spending the money elsewhere to solve the problem, impacting your potential revenue.

List two or three companies in each category to get a complete view of the competitive pressures you face. To find these business competitors, you can perform simple Google searches for the problems you solve. You can also review industry reports or even use a competitor analysis tool to see who shows up for your keywords.

Step 2: Gather the Right Information

Now that you know who to look at, you need to know what to look for. Do not try to catalog everything; that leads to data overload. Focus on the information that helps you answer, "Can we win?" and "How do we lose?".

Here is a simple checklist of data sources to get you started:

- Website and SEO: What is the main message on their homepage? What is the user experience like on competitors' websites? You can use an analytics tool or a competitor analysis tool to see what keywords they target in page titles and headers, or even what they are bidding on in Google Ads.

- Content Marketing: Do they have a blog, a resource center, or a video library? Pay close attention to competitors' content and the topics they cover, as this shows what problems they are trying to solve for their audience. Some tools like Owletter tracks competitor newsletters, giving you direct insight into their messaging.

- Social Media & Ad Copy: Analyze their social media presence across different platforms. What kind of engagement do they get? Review their ad copy to understand their key value propositions and calls to action.

- Key Offers: What are they trying to get visitors to do? Are they pushing a free demo, a whitepaper download, or a webinar? This reveals their lead generation strategy and how the competitors sell their services.

- Customer Voice: What do reviews and testimonials say? Look for patterns in praise and complaints about what the competitors sell. This competitive intelligence is pure gold for your strategy.

Step 3: Analyze and Find Opportunities

You have the data. Now you need to turn it into insight. A simple SWOT analysis is perfect for this task and is a common feature in any good analysis template.

Grab a piece of paper or open a new document and make four quadrants. A SWOT analysis stands for Strengths, Weaknesses, Opportunities, and Threats.

| Strengths (Internal, Positive) What do you do better than them? What are your key differentiators? |

Weaknesses (Internal, Negative) Where do they do better than you? What are your vulnerabilities? |

| Opportunities (External, Positive) What market gaps can you fill? What emerging needs can you meet? |

Threats (External, Negative) What market trends or competitor actions could hurt you? What external conditions could harm the business? |

Fill this out for each competitor, which will help patterns emerge quickly. The goal is not just to fill the boxes, but to connect them. This exercise provides critical competitive intelligence.

For example, you might see a Weakness: "Competitor X has a much lower price." But then you spot an Opportunity: "Their customer reviews say their support is terrible." You can now build a strategy around your superior customer service to justify your higher price.

Step 4: Take Action

Research is worthless if you do not act on it. The process of conducting competitive analysis must lead directly to a list of action items. This turns your findings into a tangible business strategy.

Maybe you discovered your top competitor gets all their leads from a specific type of content. Your action item is to build a better piece of content on that same topic. Or maybe you learned their sales process is slow and clumsy; your action item is to streamline your own process and highlight that speed.

Every insight you gain should lead to a concrete task. This is how a proper competitor analysis drives real growth and informs your general business direction. This action-oriented approach is fundamental to a good marketing strategy.

The Hidden Danger: Getting Lost in the Data

It is easy to fall into the trap of endless research. You can spend weeks building complex spreadsheets and feel very productive. But all you are doing is collecting data, not creating a strategy.

Set a deadline for your research phase when you conduct market research. Give yourself one or two weeks to gather information, then stop. You must then shift your focus to analysis and action.

Remember, the goal is not to copy your competitors. According to a classic Harvard Business Review article, competitive strategy is about being different. It is about deliberately choosing a different set of activities to deliver a distinct mix of value. Your research should show you where you can be different, not how you can be the same.

The Challenge of Partners Who Are Also Competitors

In complex industries like enterprise software, your world can get messy. You often find yourself in large projects where you have to partner with other firms. Sometimes, these partners are also your direct competitors.

This creates a difficult environment for the client. They now have to manage multiple points of contact, and when issues pop up, finger-pointing can start. The client gets caught in the middle, which is frustrating.

But you can turn this challenge into a huge win. If you can be the one who streamlines communication and takes ownership of problems, you become a critical partner. You win by making the client's life easier, not just by having the most technical skill. This is a powerful way to stand out when your services look similar on the surface.

Conclusion

Doing effective competitor research is not about creating the perfect report. It is an ongoing, strategic process that gives you the clarity to make better decisions for your business. By focusing on whether you can win and how you might lose, you cut through the noise and get straight to what matters.

This process gives you a roadmap. It highlights the open lanes where you can speed ahead and the roadblocks you need to avoid. Good competitor research removes the guesswork, so you can stop reacting and start leading in your market.

We are a full-service Hubspot Certified Inbound Marketing and Sales Agency. In addition, we work to integrate your SAP System with Hubspot and Salesforce, where we have a deep delivery capability based on years of experience. Please our book a meeting service to get started.